A strange finding on the use of NewLaw providers by BigLaw firms

A strange finding on the use of NewLaw providers by BigLaw firms focuses a seeming omission in the 2016 Alternative Legal Service (ALS) Study by the Thomson Reuters Legal Executive Institute, Georgetown University’s Law Center for the Study of the Legal Profession and Oxford’s Saïd Business School.

The Study surveyed corporate law departments and traditional law firms on their use of Alternative Legal Service (ALS) providers. Law firms and law departments in the US, UK, and Australia were surveyed, but only the US findings were reported because of small numbers in the UK and Australia.

The report on the Study – published Thomson Reuters, owners inter alia of Pangea3, a provider of what they term managed legal services – there is no mention of ALS providers being – or becoming – direct competitors to traditional BigLaw business model law firms. The authors focus on the use by law firms and law departments of ALS providers stating, for example, “The Alternative Legal Service Study reveals a seismic shift that has already happened with 51% of law firms and 60% of corporate legal departments currently using Alternative Legal Service Providers for at least one type of service.”

Of particular interest to me is the inclusion in the aims of the Study of “whether law firms view the model as a threat or an opportunity” (cited in the Executive Summary).

In a February 2017 Forbes article on the top strategic issues for US BigLaw firm leaders, authors David Parnell and Patrick Mckenna reference the Study and note “one particular issue … received minimal attention in spite of the very recent report “The 2017 Alternative Legal Service Study”. Under the sub-heading Surprising Unmentioned-ables, David and Patrick refer to alternative legal service providers ‘taking work away from traditional firms’, i.e. posing a threat.

A strange finding on the use of NewLaw providers

The findings are ‘strange’ in that ALS (or as we call them NewLaw) providers of many, but not all kinds, are well positioned to disintermediate BigLaw firms. By ‘disintermediate’ I mean by-pass traditional law firms and supply end-clients directly, i.e. be a threat. This is business strategy 101, yet it is not reported.

Australian evidence

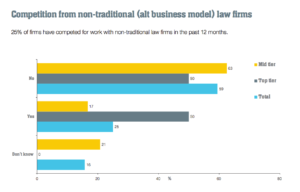

Our surveys of Australian law firm leaders clearly demonstrate that BigLaw leaders do perceive NewLaw providers as a threat. These surveys are sponsored by the Commonwealth Bank and independently researched by Beaton Research + Consulting.

Our surveys of Australian law firm leaders clearly demonstrate that BigLaw leaders do perceive NewLaw providers as a threat. These surveys are sponsored by the Commonwealth Bank and independently researched by Beaton Research + Consulting.

This 2014 chart shows 25% of some 40 BigLaw leaders reported competing with NewLaw providers, with the combined frequencies of ‘somewhat’ and ‘rare’ ranging from ~50% to ~75%.

By the 2017 survey both the very large and the mid-size firms reported they saw a growing, but modest, threat from NewLaw in two years time (page 12).

Comparative evidence

Our 2016 Delphi-type forecast of shares of the product ($ spent annually) of the legal services supply chain. We compared the US, Canada, UK, Australia and Western Europe. In summary, and corroborating the conclusions above, the majority of traditional BigLaw business model firms will fail to remake themselves by 2025 and lose share to NewLaw, amongst other types of provider. Further, we found ‘remade’ BigLaw firms gain share at the expense of traditional BigLaw firms earliest and fastest in the UK and Australia, with the US lagging well behind. We also found client law departments gain the largest share by 2025 in the US.

Conclusion

I welcome readers’ observations and experience on the work-in-progress interplay between BigLaw and NewLaw. Business strategy 101, to which I refer above, would suggest the game is headed towards classic co-opetition. That is, the two types of providers will both compete with each other and collaborate with NewLaw supplying BigLaw and also working together to supply clients.

George Beaton

George, we’ve taken the strategic position at Elevate that we will serve both law departments *and* law firms. Some law firms lean in on that, e.g. we help them run their firm support services more efficiently or procure more effectively; others pitch our efficiency legal services capabilities, alongside their expertise, as their alt legal service provider partner; some partner with us strategically for our consulting or analytics capabilities to law departments to help the firm compete with the Big 4/Accenture; some co-design software with us; other firms ignore us; and some treat us as competitors. There doesn’t appear to be ‘one size that fits all’. We’ve learned over the years not to waste energy trying to fit a square peg into a round hole. If a law firm wants help, we will provide it, but we don’t try to force a law firm to change. At the end of the day, law firms and law companies sometimes collaborate and sometimes compete to serve law departments.

Liam Brown

Founder and Executive Chairman

Elevate

Thanks for sharing the Elevate experience with readers of The Dialogue, Liam. The segments you describe (i.e. different groupings of firms in terms of how they see their needs and their behaviour to meet these needs) resonate with me. And, as Mike O’Horo says in his comment, the segments represent different stages of the diffusion of the innovations that Elevate is introducing as a NewLaw firm.

No surprise to me. This reflects the normal adoption/diffusion rate of most innovation. (BTW, kudos to you for the Edward DeBono reference, “co-opetition.”)

In the mid-’90s, during law firms’ branding heyday, the featured speaker at an LMA conference was a Marketing VP from Citibank, which had just gone through a massive rebranding. During the Q&A, someone asked how they managed to get all the stakeholders on board with such a wrenching endeavor. His response was pithy: “It wasn’t hard. The Chairman said, ‘This is what we’re going to do. Get on the train, or get in front of it.'”

Adapting to and embracing inescapable change driven by relentless innovation is our industry’s version of that train. Get on it, or get in the way and get crushed.

Mike, gruesome as the metaphor sounds, it hopefully sends a call-to-action to the majority of firms that are standing on the sidelines watching and wondering whether to ‘do something’. Without plugging too much, this is exactly the reason Imme Kaschner and I wrote ‘Remaking Law Firms: Why and How’.

The mindset of traditional law is based on the leap of faith assumption that clients are prepared to fund a delivery model in which resources are owned and directly controlled by the provider. In order to protect those resources, other providers – including NewLaw once the arena opened up – were generally regarded as potential substitutes and thus a threat. That leap of faith assumption no longer holds true and law firms are starting to embrace a collaborative mindset towards other providers, often at the request of clients. The idea of working with existing or potential competitors makes some in the profession uncomfortable but there are best practice principles, developed in alliancing and collaboration, that help avoid or limit the commercial tension that co-opetition brings. ISO 44001 is an international standard which helps organisations develop effective collaborative business relationships. Mike Nevin’s book The Strategic Alliance Handbook contains an entire chapter on “Sleeping with the Enemy.” The SRA has at last announced that it will free up solicitors to provide non-reserved legal services outside regulated firms (“at the moment…anyone from a plumber to an accountant can provide legal advice in [non-regulated] firms, but not a solicitor” – SRA Response, June 2017).… Read more »