Has the juice been squeezed from BigLaw’s business model?

Central to the profitability of the ‘BigLaw’ business model is how rainmaking equity partners, i.e. the owners, win work for the firm and enlist other fee-earners to do the bulk of this work. Since the 1950s, this model has been hugely successful, both in serving clients and making a great deal of money for owners. However, the capacity to exploit this business model has a ceiling; and this appears to be fast approaching.

Analysing the legal markets of major common law jurisdictions, including Australia, the UK and the US, reveals varying degrees of profitability growth amongst traditional BigLaw firms over recent years. While BigLaw owners may be encouraged by some reports of profit figures, the evidence points to partnerships squeezing the last they can out of the BigLaw business model’s profitability levers. As new forms of competitors continue to emerge and take market share from BigLaw, its profitability levers may soon become ineffective.

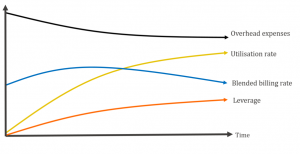

Maister’s profitability levers – intuited trends

Maister’s equation to calculate and manage the profitability of law firms can be represented as follows:

Profit is distributed to equity partners (EP) in proportion with their share of the equity points (Points), giving rise to an average profit per point, PPEP (if the denominator is the number of EPs, rather than points on issue, then PPEP refers to the average profit per EP). Leverage (L) is number of fee-earners for each EP. Utilisation (U) is the number of hours per fee-earner, including EPs, per year charged and recovered from clients. Blended billing rate (BBR) is calculated dividing the firm’s fee income by the firm’s total U. Total Expenses (TE) is all costs incurred in operating the firm.

BigLaw firms have long been guided by Maister’s formula, manipulating the levers of U, L, BBR, TE and Points to maximise profitability.

What the evidence points to

While complete data pertaining directly to Maister’s profitability levers is elusive, and exogenous factors clearly affect profitability as well, it can be inferred from commonly published metrics that firm leaders are driving the levers very hard. This strongly suggests that PPEP maintenance, let alone growth, in the sector may not be sustainable.

Leverage and Utilisation

Maister’s schematic demonstrates that L and U cannot grow indefinitely under the BigLaw business model. This is intuitive. With respect to L, partners can only lead and supervise so many non-partner fee-earners without compromising quality. Further, if the carrot of equity partnership becomes too distant for lawyers to achieve, they will opt out of the tournament for partnership. With respect to U, there are only so many billable hours in a day that lawyers can or will work. Examining these levers in Australia, the UK and USA yields interesting results.

Australian firms have seen rising PPEP growth in recent years. Analysis of beaton’s bi-annual results reveals a 6.2% reduction in L for some of Australia’s largest firms[1], while L fell by 10.9% across the 44-firm survey. According to the Thomson Reuters’ Australia: State of the Legal Market report, demand growth for legal services has been negative since 2013. These trends reflect a plateauing ability of firm leaders to leverage their business due to poor demand.

Despite this, PPEP has been on the rise. This is consistent with increasing ‘productivity per lawyer’ figures in the report. Far from reflecting more efficient productive output from lawyers, ‘productivity per lawyer’ is simply higher U (i.e. fewer lawyers are being pushed to work more billable hours). Increasing profitability through this tactic is likely to soon reach its limit.

In the UK, analysing historical results from the Legal Week Top 50 reveals L has somewhat increased from 2010-11 to 2014-15, showing an interesting correlation with PPEP. While different to Australian firms, this strategy still reflects a push eke out as much as possible from Maister’s profit levers; firms are increasing revenue per partner via increasing L to drive profitability. For reasons stated above, this strategy has limited potential for growth, particularly with falling demand for legal services.

Conversely among the largest firms[2], L slightly fell by 4.3% over the same period while PPEP and revenue both grew. In the absence of demand for legal services increasing, this suggests that profitability has been propped up by increased BBR and/or increased U. Again, U and fees can only be pushed so far, and in a hyper-competitive market there will likely be push-back on fee levels from clients.

In the US, the 2016 AmLaw100 survey results indicate that PPEP grew by 4% in 2015. However, de-equitisation of 0.6% meant that PPEP growth was inflated on average. In the case of some firms this turned what would have been negative PPEP growth into positive.

Georgetown University’s 2016 Report on the State of the Legal Market confirms that leaders have improved profitability through increasing L, as well as through rate increases. The number of lawyers has increased, while their productivity (U) has fallen consistently over the past 4 years. Firms have propped up their PPEP by increasing their fees, despite push-back from clients in the form of falling realisation rates (i.e. firms are collecting less as a proportion of what they record). It therefore appears that with reduced demand for legal services, US firm leaders will struggle to continue increasing their L without sacrificing U, as there simply won’t be enough work for non-partner fee earners to bill to clients.

Sourced from Georgetown University’s State of the US Legal Market Report

Blended billing rate and expenses

Without demand for legal services improving significantly, continued increases in fees appear unsustainable. This is evidenced by falling realisation rates in both Australia and the US – clients are pushing back. This will eventually have a dampening effect on BBR (which reflects fees actually collected) and thus on the fees themselves.

In the absence of direct data for the UK, it is unclear whether increasing RPL and PPEP amongst the largest firms reflects higher fees, higher U or a combination of both. Regardless, improved demand will be required to squeeze more out of either in a hyper-competitive market.

Expense growth (TE) has been more or less flat since the GFC in the US, and is significantly lower than pre-GFC levels. In Australia, TE growth has been negative, but there is insufficient evidence in either market to suggest that firms are engaging in austere cost-cutting measures to drive their profitability. TE data for the UK is unavailable.

Conclusions

There is a limit to the profitability growth that can be achieved through the traditional BigLaw business model. Firm leaders have seen some success over the past 5 years in improving profitability. However, the evidence suggests that this reflects tinkering with Maister’s profitability levers, rather than exogenous factors such as an improved value proposition from BigLaw firms, or a return to favourable legal market conditions.

Profitability growth is likely to flatten, which will only be accentuated by the competitive pressures of NewLaw businesses.

Further reading

BigLaw profitability needs a new approach

Evidence: Why BigLaw must start remaking now

The rise and rise of the NewLaw business model

Last days of the BigLaw business model?

More NewLaw M&A: Elevate acquires Legal OnRamp

Author

![]() Ben Farrow is a Consulting Analyst at beaton. He holds degrees in commerce and law from the University of Melbourne and delivers clear, actionable advice to clients. You can connect with Ben on LinkedIn and contact him at ben.farrow@beatonglobal.com.

Ben Farrow is a Consulting Analyst at beaton. He holds degrees in commerce and law from the University of Melbourne and delivers clear, actionable advice to clients. You can connect with Ben on LinkedIn and contact him at ben.farrow@beatonglobal.com.

[1] Results for the 2015 top 20 firms (by revenue) for whom there was consistent data were analysed by beaton. This amounted to 17 firms.

[2] Results for those of the 2015 top 20 participating firms (by non-partner fee earner) for whom there was consistent data over the past 5 years were analysed by beaton. This amounted to 19 firms.

– See more at: http://www.beatoncapital.com/2016/05/biglaw-businessmodel-profitability/#sthash.qpPpxjE1.dpuf

This is an interesting article. That said, I do not understand the need to take shots as Maister’s profitability formula as though it were some kind of inducement to commit evil acts. News Flash: It’s just a formula! It’s a tool that measures elements from which profitability may come. Maister himself acknowledged the limitations to the formula. In my humble opinion, one of a number of factors that this author ignores when talking about leverage is firms doing work on an AFA flat fee basis and then utilizing “contract lawyers”, with some years of terrific experience but who want to determine their own life style and work from home. For example, in New York City, one of the highest priced markets on the planet, I can procure the services of such a contract lawyer, with at least 8 years of good practicing experience for the ludicrous hourly rate of $35.00 The author suggests that “there is a limit to the profitability growth that can be achieved through the traditional BigLaw business model.” I respectfully disagree. For those engaged in large litigation matters or even doing more routine work, between just using contract lawyers and sophisticated AI-based technology tools, I’m watching… Read more »

Patrick, thank you for your News Flash.

While the Maister formula is indeed just a formula, it is reasonably good at explaining how most firms continue to make their money. As with any such model the assumptions are broad. There are many exceptions which are well beyond the scope of the post.

However, I would argue that firms innovating to improve their value proposition (such as those to which you allude) are just that – exceptions. They are in the process of adapting their business model and don’t fit within the definition of ‘traditional’ BigLaw firms (to the extent that bright line distinctions can be drawn). To be fair, some such firms would have been captured in my analysis which to some extent confounds beaton‘s overall thesis.

That said, when examining the industry at a macro-level, I still believe that recent growth figures generally reflect tinkering with the inputs outlined by Maister rather than substantive improvement. Those that continue to use this strategy are unlikely to enjoy success in the long run.

Well Ben, I guess we will have to agree to disagree.

Many have been reading and hearing all about how law firms need to change or die (as if that is some catalyst to take action) since late 2008 and yet . . .

• We have NYC-based firms charging $1600/hour to clients happy to pay for their specialized expertise;

• We see Legal Week’s Innovation Awards last week given out to mostly large law firms;

• And while I have no first-hand experience with Australian or New Zealand firms, many of the larger firms I work with in North America and Europe are expending serious resources and energy in improving their efficiencies (sustaining strategies) and exploring new revenue streams (growth strategies).

And these are not the exceptions.

I continue to think the formula is a bad thing on lots of levels. For firms that still are largely hourly, the formula has made management’s activities as close to mindless as running a business can get. Just keep requiring more hours from fee-earners and keep raising their hourly rates. And if all else fails, you can always manipulate the fraction by de-equitizing partners and extending the time to partnership for those moving up the ranks even though these actions might undermine client satisfaction, attorney retention rates and true profitability. The formula also keeps blurring the concept that partner incomes are (or should be) based on two separate components: compensation for their professional services (salary) plus a payout on their ownership shares (equity). In most other businesses, cash bonuses can vary widely year to year, and in some years might be zero. Similarly the value of stock and stock options will typically fluctuate widely year to year. Yet law firm leaders and their partners – even as they claim they are now running their firms more like a business – somehow believe their annual incomes (salaries and equity) can only go up and never down. Because the formula is also… Read more »

For those looking for an online dustup complete with rigid taking of sides and amplifying rhetoric, I suggest you read no further because I”m confident I’ll disappoint. In my view, both Ben and Patrick are right, or neither is wrong, and indeed I don’t see much contradiction or inconsistency between what they’re saying. Ben’s article, as I read it–perhaps colored by my having the same thoughts myself albeit in slightly different form–is performing a valuable and timely but limited service of working through the implications of Maister’s model and pointing out (mildly enough) that none of the key variables embodied in it can grow to the sky. This is surely correct. Leverage will reach a point where clients won’t put up with it, associates won’t stand for it, or demand won’t support it. Utilization reaches the limits of the human body and mind to add productive hours to the day, week, and year; and/or (again) constraints on deand. Blended billing rates have some natural ceiling. Sure, individual partners may bill $1,000 or $2,000 an hour, but how many of those can there be in any functioning and stable law firm? Even Major League Baseball teams can’t be composed of .400+… Read more »

My take on this discussion – and the thesis prosecuted in Remaking Law Firms: Why & How – is based on the distinction between competitive strategies and business models.

The former explains how a firm seeks to differentiate itself from close competitors; the latter determines how a firm makes money. Maister’s formula focuses on the business model, not the basis of competitive strategy.

Thus, the examples how firms are growing and specialising cited by Patrick are indeed excellent examples of competitive strategies. But they are still built on the traditional BigLaw business model, first enunciated by David Maister and now empirically analysed by Ben in this post.

This conversation is not about one being right and the other wrong. It’s about two different, but not unrelated, topics.

The title of this posting was the question: Has the juice been squeezed from BigLaw’s business model? In one of my responses, I suggested that it had not, certainly based on my work and observations throughout North America and Europe. But I also said that I “have no first-hand experience with Australian or New Zealand firms.” This morning I was struck by an article (http://www.edge.ai/2016/05/8-reasons-optimism/?key=eic) penned by Dr. Neil Oakes who has worked with the Australian legal profession since 1989 and who tells readers that “there remains cause for optimism, certainly in Australasia.” He sites a number of interesting points including: • The ‘disrupters’ don’t seem to be disrupting. There has always been space in the Australasian market for firms of all shapes and sizes. In recent years we’ve seen a number of alternative models emerge. What we have not seen is a rush of clients away from existing firms to the providers of ‘new law’. Nor have we seen market incursion by non-lawyer providers or new entrants in significant numbers. The profession is, in fact, remarkably stable. Lawyers may be practising inside alternative structures or under international brands, but the number of practising certificates relative to total legal market… Read more »

To add grist to this mill, here’s a recent Peer Monitor US report stating “Law firms were ‘blindsided’ by a drop in demand across nearly all practices. The 0.9% decline breaks a streak of nine consecutive quarters of increased demand, the longest such streak since the 2008-9 financial crisis.” https://peermonitor.thomsonreuters.com/wp-content/uploads/2016/07/PMI_Q2_2016_FINAL.pdf